Old Taxes 2

Preface: There used to be an Old Tax System in all of BattleMaster, which was replaced with the current system in 2007.

Contents

Introduction

The new (now implemented and no longer experimental) tax system models are more realistic and more interesting tax collection system. It replaces centralized tax management with distributed tax collection and distribution, giving local lords more power and responsibility. It also strengthens the hierarchy.

Where Do Taxes Come From?

In short, tax gold comes from the people of your region. They live their lives, make their money, and turn over some of it to the tax collectors. This money is used to pay for each region's militia and maintenance, and each regional lord sets percentages to send to his knights, his Duke, or the realm. Some additional gold may come from trading; and the pockets of wealthy troop leaders (those that hold more than the limit of the property and wealth tax set by the banker, calculated separately for both gold and bonds) are also assessed a tax to be shared realm-wise, but most of your gold will come out of the pockets of the people of your region.

Producing Gold

Some regions in BattleMaster are wealthier than others. This is shown by Gold ranking for the region, which shows the amount of gold produced at 100% production. Every day, the region generates gold, according to the current level of production, and the region's gold rating. A percentage of that is taken by the tax collectors, and stored in the region.

While the gold is sitting in the region, it can be an attractive target for infiltrators or looters.

Regions without local lords collect only partial taxes, so it is important to have a lord in charge of every region, who can enforce the taxes. Peasants do not enjoy paying taxes, and will "forget" about it if given the chance.

Collecting Gold

Taxes are collected automatically every seven days, or the banker can call for an early tax. On tax day, the treasuries of each region are collected and distributed according to the Lord's settings and the region's needs.

Before it can be distributed, the region has a few expenses which must be taken care of. Militia must be paid, first of all, and the region will even take money from the rest of the realm to pay their troops. Once militia have been paid, building maintenance is charged, then, if there is any gold left over, the percentages set by the region Lord take place.

If realm control is very low, then some or all of the region's tax gold may be stolen on tax day.

As an intended game-mechanic, if a region doesn't have a Lord on tax day (for example the Lord retired or got deported shortly before tax day) then all taxes collected throughout that week are halved, and additionally any gold that would have gone to the Lord are instead sent to the realm. As an RP rational, it can be assumed that the lack of a Lord on tax day leads to "missing funds" (aka corruption).

Regional Tax Distribution

The backbone of the new system is that every region sets its own tax rate and collects its own taxes. These taxes are used to pay for militia, maintainance, etc. The remains are then distributed:

- down the hierarchy, towards the knights of the region lord

- up the hierarchy, towards the duchy

- up the hierarchy, to the realm

- whatever is left goes to the region lord.

The region lord sets the percentages for all of these factors. This generates the demand for internal politics, as dukes will (hopefully) try to get their lords to contribute as much as possible to the duchy, while the government (ruler, banker, etc.) will lean on the lords to contribute directly to the realm.

Things to consider:

- Duchy shares raise the tax income of the duchy region. Which in turn raises the duchy's contribution to the realm. Or in other words: A duke who can get his lords to contribute more to the duchy and less to the realm can in turn raise his own contribution to the realm (passing the lord's share through, if you will) and will thus personally look better with a higher contribution.

- Shares can be interpreted as loyalty. A region lord who contributes much to his duchy, but not much to the realm - or vice versa - might have questionable allegiances.

- A duchy in need (e.g. a heavily looted city) can use duchy shares of its region lords to pay for maintainance and militia, even if it could not afford them itself.

- Militia and upkeep are paid from the regional taxes now. In other words: Regions have to be able to sustain themselves.

- Anything not sent to the knights, duchy or realm goes to the region lord. Let's say this again, for those hard of hearing: set your duchy and realm shares low and you'll be rich in no time

Up the Hierarchy

Anything sent to the duchy will be added to the tax collection of the dukes region. Then, the same rules apply for him except that there's no duchy share, only a realm share.

The realm collects the realm shares from all regions. There is also a minor "other income" factor, as before. And there is the taxes on troop leaders, as before. So there will be a still considerable realm tax income, and the banker, as before, sets its distribution.

Things to consider:

- If the government members are not region lords, they will often have no other source of income, so their shares will be fairly high.

- When choosing the settings, remember that almost everyone else will already be getting tax gold from their region or their liege. Except for unaligned nobles, and you'll have to decide how much you want to support or punish these.

Down the Hierarchy

In addition to the duchy and realm shares, local lords are also responsible to pay their knights. This is done through a simple "pay-for-service" deal. The lord offers his knight a fixed share of the tax income for his service. Both sides have to agree to the deal, each side can resolve the deal at any time.

Things to consider:

- Remember that these are fixed shares. They do not change if additional knights are recruited. If the first knight was offered 10%, he will get 10% no matter if he's the only knight or if there are 2, 5 or 20 others.

- It is important for the region lord to estimate the number of knights he'll have somewhat correctly. More knights mean either less gold for him, or less for the duchy and realm...

- If the number of knights goes way beyond what was expected, it may be necessary for the local lord to re-negotiate some deals, i.e. ask knights to agree to a new deal with a smaller share. Lots of political potential here, if the knights don't just fold but request some other favour in return...

Flow of Taxes

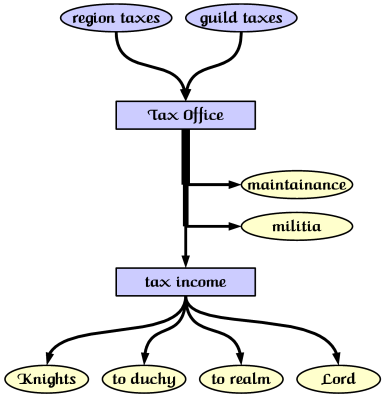

The graph to the right shows the flow of tax money in a regular region. Taxes are collected from the region's peasants and from guildhouses within the region.

This initial collection is then used to pay for maintainance and militia.

Whatever is left will be distributed to the knights, duchy and realm according to the shares set by the region lord. Whatever is not distributed goes to the lord.

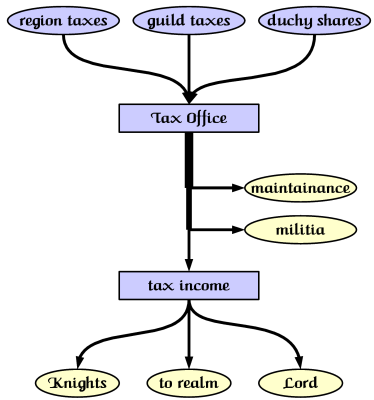

The second graph shows the flow through a duchy main region (a city or stronghold). The only changes from a normal region (above) are that duchy shares are added to the tax office (before militia and maintainance are paid, allowing a duchy to support more than the region itself could) and that there is no duchy share.

The Math

Here is the math on tax collection, for those who really can't resist. Normally, you shouldn't need to worry about any of this, because the game takes care of it and tells you the results where they are needed.

Following the flow above, several things immediately follow:

- Knight shares are unaffected by realm and duchy shares.

- Knight shares are affected by local maintainance and militia.

- Knight shares are affected by whether the region has a Lord on tax day.

- Half of the collected taxes for the whole week go "missing" on tax day without a Lord.

- Duchy shares increase the gold available for expenses for the duchy main region.