Difference between revisions of "New Taxes"

(Created page with "This tax system is part of the New Estate System and not yet live. It will go live on the testing islands very soon, and on stable not too long afterwards. == Taxes == __NO...") |

|||

| Line 1: | Line 1: | ||

| + | __NOTOC__ | ||

| + | |||

This tax system is part of the [[New Estate System]] and not yet live. It will go live on the testing islands very soon, and on stable not too long afterwards. | This tax system is part of the [[New Estate System]] and not yet live. It will go live on the testing islands very soon, and on stable not too long afterwards. | ||

| + | = Region Taxes = | ||

| + | [[Image:NewTaxes.png|right]] | ||

| − | + | The flow of tax collection within a region is shown in the flowchart to the right. The basics are: | |

| − | + | * Peasants pay their taxes as determined by the tax rate | |

| − | + | * Guildhouses and temples (half tax rate, round up) pay taxes | |

| + | * The regions trade balance adds or substracts to this total | ||

| + | * Expenses such as buildings and militia payments are deducted from this total | ||

| + | This results in the tax gold available for collection. | ||

| + | |||

| + | The tax collection is done by the knights of the region, each within his own estate. The lord collectes collects from any vacant estates and unassigned, wild lands. Collection in vacant estates and wild lands is at reduced efficiency, with a loss of about 50% of the tax income. | ||

But the knights, lords and dukes all not being the actual owners of the land but only holding them in fief for the next one up the hierarchy, they all have to give a share of their income to their betters. | But the knights, lords and dukes all not being the actual owners of the land but only holding them in fief for the next one up the hierarchy, they all have to give a share of their income to their betters. | ||

| Line 14: | Line 23: | ||

For better coordination, the tax rates are set per-region by the regional lords, while the day of the tax collection is determined by the realm banker. | For better coordination, the tax rates are set per-region by the regional lords, while the day of the tax collection is determined by the realm banker. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | = Realm-Wide Taxes = | |

(propery and wealth tax will be described here once the exact details have been decided) | (propery and wealth tax will be described here once the exact details have been decided) | ||

[[Category: Manual]] | [[Category: Manual]] | ||

Revision as of 14:55, 10 September 2011

This tax system is part of the New Estate System and not yet live. It will go live on the testing islands very soon, and on stable not too long afterwards.

Region Taxes

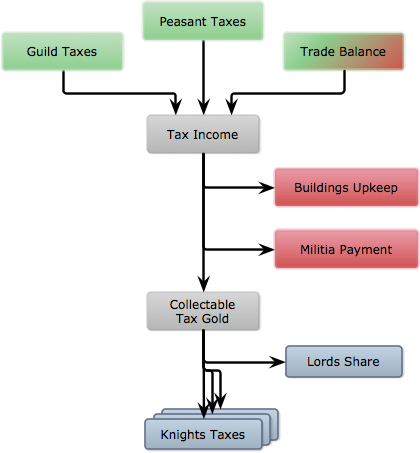

The flow of tax collection within a region is shown in the flowchart to the right. The basics are:

- Peasants pay their taxes as determined by the tax rate

- Guildhouses and temples (half tax rate, round up) pay taxes

- The regions trade balance adds or substracts to this total

- Expenses such as buildings and militia payments are deducted from this total

This results in the tax gold available for collection.

The tax collection is done by the knights of the region, each within his own estate. The lord collectes collects from any vacant estates and unassigned, wild lands. Collection in vacant estates and wild lands is at reduced efficiency, with a loss of about 50% of the tax income.

But the knights, lords and dukes all not being the actual owners of the land but only holding them in fief for the next one up the hierarchy, they all have to give a share of their income to their betters. Every level of the hierarchy defines the share the levels below contribute up:

- The king decides the "kings share" - the % of income the dukes have to send to him

- The dukes decide the "dukes shares" - the % of income the lords have to send to them

- The lords decide the "lords shares" - the % of income the knights have to send to them

For better coordination, the tax rates are set per-region by the regional lords, while the day of the tax collection is determined by the realm banker.

Realm-Wide Taxes

(propery and wealth tax will be described here once the exact details have been decided)